Le webzine spécialisite en article de maroquinerie et bagagerie de créateurs sur Paris et partout en France. Retrouvez chaque mois des articles dédiés à nos marques préférées ainsi que de nombreux conseils pour commencer vos propres créations.

Apprendre à coudre, se balader dans notre chère capitale pour s’inspirer des créateurs les plus en vogue, connaître les bonnes adresses sur Paris, on vous dit tout! Rejoignez la première communauté de créateurs sans plus attendre.

Les qualités requises pour devenir créateur de sacs et d’accessoires de mode

Un véritable métier d’art et de création qui séduit de plus en plus de personnes, un créateur de mode ou encore appelé couramment styliste est une personne ayant pour but de créer de nouvelles collections que ce soit en matière de prêt-à-porter et de mode haut de gamme qu’il prend soin de réaliser grâce a des dessins et des croquis de grande qualité.

Son rôle est donc de détecter les différentes tendances de modes pour par la suite proposer des créations originales ce qui fait de lui une pièce maitresse pour une marque ou une entreprise de mode.

Que soit en terme de vêtements, de chaussures, de sacs, un styliste habille les mannequins de la tête aux pieds et même si dans ce secteur la concurrence est rude, le métier de styliste reste très recherché et en vogue aujourd’hui.

En quoi consiste le métier de styliste ou de créateur de bagagerie ou de maroquinerie ?

Cette profession a pour principal essence l’imagination, confectionner sur papier ou à l’aide des outils informatiques des croquis de vêtements et des dessins de modes.

Avec ses connaissances des différentes techniques de stylisme modélisme, il ou elle a pour responsabilité après validation de l’équipe d’une marque de façonner les prototypes de sacs ou d’accessoires et d’effectuer si nécessaire des retouches en fonction du mannequin et du vêtement lors d’un défilé de mode par exemple.

Etant passionné(e) de la mode, il ou elle peut travailler seul(e) ou en équipe pour la création de nouvelles collections. Et enfin ce métier ne se limite pas aux connaissances artistiques mais demande aussi des connaissances en stratégies marketing de la mode en vue de pouvoir facilement ses oeuvres.

Afin de vous faire connaître, pourquoi ne pas créer un blog avec vos créations? Vous ne créez pas encore? Alors pourquoi ne pas sélectionner les dernières tendances de la maroquinerie et de la mode en général pour créer un site d’actualité, cela vous permettra de développer votre réseau. Prenons comme exemple Paul, un créateur réputé et ancien collègue qui anime aujourd’hui un site spécialisé dans la bagagerie et les accessoires appelé ebagagerie.

Quelles sont réellement les qualités requises pour devenir créateur de sacs et d’accessoires ?

Une bonne formation dans le domaine stylistique et de l’art permet d’acquérir des compétences indispensables pour exercer dans le domaine de la mode.

Pour devenir styliste, il est indispensable d’avoir un bon coup de crayon, donc de savoir dessiner tout en maitrisant les outils informatiques et il faut aussi être doté de quelques qualités.

Nous pouvons citer par exemple : la créativité, l’audace, la rigueur, la passion, la minutie, le bon sens de l’observation, connaitre des différentes techniques de fabrication d’un accessoire, maitriser l’environnement culturel, historique et esthétique du secteur des accessoires.

Où exercer ce métier et comment commencer ?

Au jour d’aujourd’hui, plusieurs secteurs d’activités sont ouverts aux futurs créateurs : Les ateliers, les maisons de modes, les grands magasins…Ce secteur étant plutôt fermé, il est conseillé de bien développer son réseau de contacts professionnels lors de sa formation et des stages en entreprise.

Il est donc possible d’exercer son activité dans une entreprise car les plus grandes marques de mode recherche des créateurs innovants et talentueux ou alors à son compte personnel par le free-lance.

Dans certains cas les créateurs de mode peuvent être à la tête de leur propre maison de mode et donc ils contribuent alors à l’image de styles et de marques en imaginant tout un univers pour sa maison de couture.Vous etiez nombreuses à nous contacter pour obtenir divers conseils. Nous espérons que cet article vous a plu.

Si certaines choses n’étaient pas claires, n’hésitez pas à nous contacter sur la page contact.

C’est toujours un plaisir d’échanger à propos de notre passion commune qu’est la création et la mode.On attends vos commentaires !

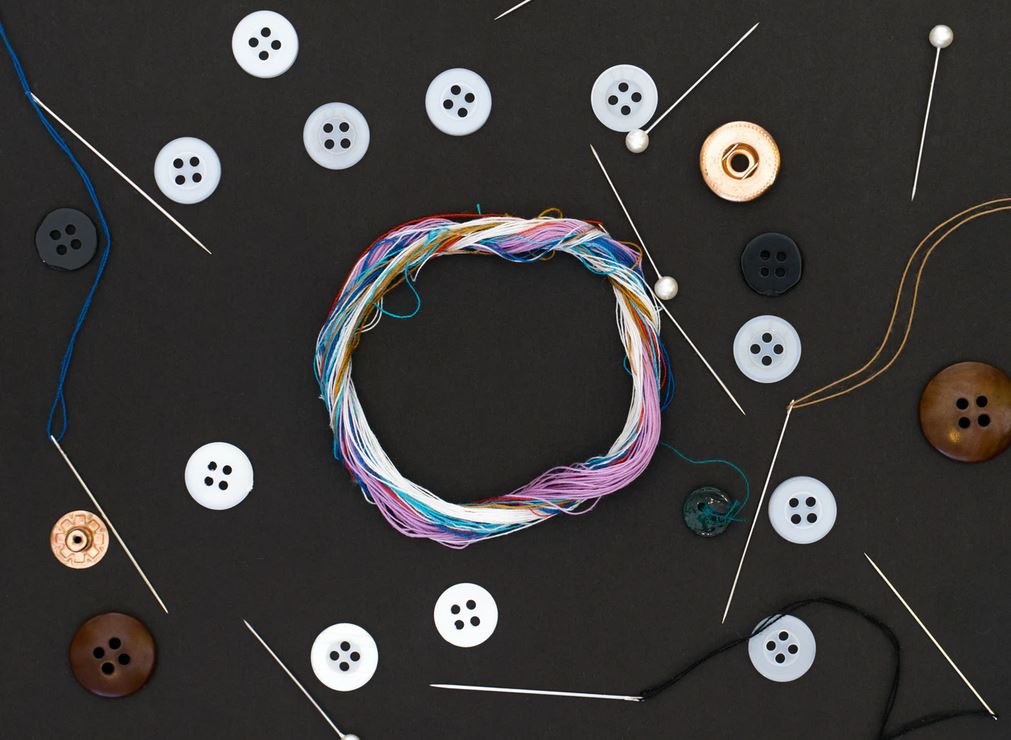

Anne-Marie, Louise et Alice: Des Filles vraiment en Aiguilles!

Vous souhaitez obtenir un devis pour une création de sac sur-mesure? Contactez-nous dès maintenant!

Contactez-nous et recevez votre devis personnalisé en moins de 24 heures. Partagez-nous vos exigences (taille, poids, volume, matériaux) ainsi que vos contraintes pour obtenir une réponse la plus détaillée qui soit.

Les derniers articles 100% mode et créateurs

Quelles sont les meilleures adresses shopping à Paris? On vous révèle tous nos secrets!

Pourquoi et comment commencer la couture? Voici tout ce que vous devez savoir pour coudre comme une pro!

Quelles sont les 10 marques à la base de créateurs qui sont aujourd’hui reconnues mondialement? Réponse ici.